Untapped potential

Sleeping speciality giant: Ecuador’s record coffee price smashed

At the 12th Taza Dorada Cupping Competition in Guayaquil on Friday – in which a panel of international judges evaluated and scored 40 samples of Ecuadorian-grown coffee – the winning coffee sold at auction for $29 per pound, smashing the previous record FOB (Free on Board) price of $20 a pound.

Coffee prices

World coffee prices averaged $0.98 per pound in September 2018, according to the International Coffee Organization. The most expensive coffee ever sold at auction was $300 per pound, achieved in Costa Rica earlier this year.

Farmer Henry Gaibor’s winning coffee, of the Typica variety, scored 90.06 against the Specialty Coffee Association of America (SCAA) cupping protocols.

Korean company Momos Coffee purchased 386 pounds of Gaibor’s green bean coffee at auction at the event to achieve the record price.

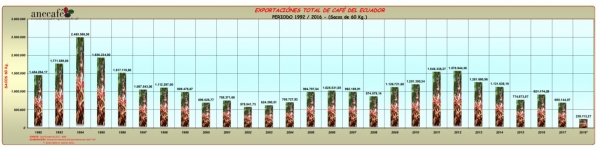

Competition organizers Anecafé, the country’s coffee export association, and Pro Ecuador hope the high price sends signals to international buyers about quality and can help turnaround the country’s coffee declines.

Coffee in Ecuador

Coffee was once a major export for Ecuador in the 1950s.

However, production has been in rapid decline for the last six years and the country produced only 160,000 bags (60-kilograms per bag) on a Green Bean Equivalent (GBE) basis in 2016/17 (April-March).

Colombia by comparison produced 14.6m bags, Peru 4.2m bags and Costa Rica 1.3m bags in the same period.

However, Ecuadorians growers are starting to plant rarer Arabica varieties, which has peaked interest among international speciality coffee buyers.

Ecuador’s domestic bean production increased in 2017/18 (April/March) due to recovery of old plantations and new cultivars, according to a USDA report published in May this year.

The report said exports increased significantly year-on-year in 2017/18 and are forecast to grow again in 2018/19.

Unrealized potential

Ecuadorian coffee farms are typically small family operations of two to four hectares with average annual productivity of 95 kg per hectare (ha)

Ecuadorian coffee - 2018/19 forecast (green bean equivalents)

- Production: 255,000 bags, +24% YOY

- Exports 742,000 bags, up 37,000 bags, +5% YOY

[Source: USDA]

The productivity rate is miniscule compared to neighbours Peru, which produced 683 kg per ha in 2017/18.

According to Francisco Castro, quality control at Costa Rican company Exclusive Coffees and a judge at the cupping competition for the last five years, this gap in yields represents an opportunity for Ecuadorian coffee.

"Quality has been growing. People are more willing to focus on quality and producers now have an environment to produce good coffee," he said.

Castro said the next step will be for buyers to build long-term relationships with coffee farmers and to bring in agronomists to improve productivity.

He said coffee plantations can support 4,000 to 5,000 plants per hectare, but said there are typically around a 1,000 plants per ha in an Ecuadorian coffee farm as it is seen as a cash crop.

Castro added Ecuador’s coffee plantations are old, around 50 years of age, shade trees are uncommon and production is almost organic – not through choice, but because fertilizer use is low.

The same has held true for decades. A World Bank Report, 14 years prior in 2004, said: “Ecuador’s coffee sector suffers from a combination of low productivity, poor infrastructure, an inefficient trade chain and a financial system entirely dependent on funds from Anecafé…”

But Castro and other international buyers at the Taza Dorado competition foresee great potential in Ecuadorian coffee.

Café Merino Lugmapata: Farm expands with Arabica

Café Merino Lugmapata a coffee plantation and green bean exporter in Palatanga is one coffee grower aiming to capitalize on international interest.

The family farm won last year’s Taza Dorado Cupping Competition, came third three years ago and had two samples in the top 10 this year (#6 and #8).

The plantation is between 1,800 and 2,000 meters altitude and has nine hectares (ha) of productive coffee.

It plans to scale up to 21 ha by 2021 and has a total of 100 ha land in which to expand if it sees strong demand.

The farm employs around 24 people and cultivates 60% Caturra and Pacamara varieties and 40% Typica and Bourbon.

The farm’s capacity by 2020 will feature more Typica and Bourbon varieties, as the family see greater international demand for these types.

They also plan to conduct trials with high-yielding, pest-resistant variety Sarchimor.

The company expects to attract interest in the local market and in Taiwan, Korea and the US.