A promising 2019? Why Brazil and e-commerce will be so important for business next year

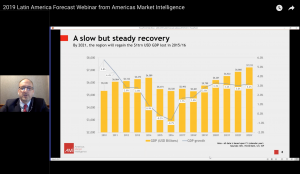

By 2021, Latin America should regain the US$1 trillion of GDP lost in 2015/16, according to The 2019 Latin America Forecast by Americas Market Intelligence. GDP should sit at 2.8% in 2019, up from 1.8% this year. Americas Market Intelligence said growth will come amid a backdrop of vast political change, continued expansion in consumer access to credit, soft oil prices, and the ongoing trade war between the US and China.

John Price, managing director at Americas Market Intelligence, said that, already, about 80% of Latin America's economy was in a “reasonably healthy financial state” and there would be “pretty decent growth” across the region in the next four years.

'Brazil is what's going to move business numbers'

But what did this mean for food and beverage manufacturers moving into 2019?

Price told FoodNavigator-LATAM it was firstly important to understood how pivotal Brazil would be to successful business in Latin America next year.

“Brazil is what's going to move business numbers across LATAM next year,” he said. “Why Brazil? Well, because first of all it's 50% of LATAM and in some categories even higher; any movement in Brazil is going to alter your global numbers and regional numbers.”

Brazil's economy was already on the mend, he said, with currency and credit strong, and the recent election of Bolsonaro as president had generated a lot of “positive confidence” amongst businesses, which would undoubtably have a knock-on effect on consumer confidence.

Price said whilst Bolsonaro's election had “caused alarm” among English-language press, what outsiders failed to grasp was the degree to which voters in Brazil were frustrated with fraud, crime and many other issues. The president-elect had already made promises to reform Brazil's economy in a way almost all other LATAM countries had already done in the 90s, he said – with pension changes, plans to shrink government, to remove international trade barriers and simplify Brazil's complex tax code, among other things.

“If he's able to achieve any of that, that's going to unleash a lot of wealth potential in Brazil. And that's what has got a lot of people very excited. ...Everybody is gearing up for a very robust Brazil.”

However, for companies entering Brazil for the first time, Price said economics and politics were less important - it was more about operational strategy.

“Generally speaking, Brazil is still a pretty fragmented market. Even São Paulo – the most important city in the country – only represents about 16% of the GDP of the country. You generally have to attack Brazil on a regional basis. ...Very few distributors and representatives can really get you into the whole country.”

The other challenge to first-time entry into Brazil, he said, was “really high” legal costs of moving around the country once in. “If it's your first market in Latin America, that's tough toll.”

E-commerce 'really exciting for niche players'

For 2019, Price said technology-driven service models would continue to be a disruptive force across Latin America and something food and beverage companies could really take advantage of.

“In food and beverage, the services component is retail and although e-commerce is pretty small – it's only about 2.5% of total retail – it's growing across the region at close to 20% a year,” he said.

This growth was being driven by two factors: convenience and pricing, he said, and was also especially popular with younger consumers. “Remember Latin America is a younger market. … They are very much ready [for e-commerce]. As younger consumers compared to Americans or Europeans, they tend to adopt new ideas a little faster,” Price said.

The expansion of big e-commerce players like Amazon had also contributed significantly to growth, he said.

Price said for food and beverage suppliers and retailers, e-commerce was “a little more complex” because of intermediaries but overall it proved “really exciting for niche players; niche suppliers of specialized products that just couldn't get the time of day with these big retailers”. Especially as bricks and mortar retail in Latin America remained very consolidated, he said.