The French multinational retail major posted a 52.1% net income rise for the first half (H1) of 2018 in Brazil, pulling in R$669m (US$180.4m). The second quarter (Q2) alone generated R$389m (US$104.8), up 39.4% on the first quarter. According to Carrefour Group, Brazil currently represented the second 'most relevant' market, after France.

'A particularly satisfying performance'

In the first half of 2018, Carrefour Brasil opened ten Atacadão wholesale hypermarkets (two in São Paulo; two in Rio de Janeiro; two in the northeast; two in the mid-west; and one in south Brazil) and said it would open a further ten later this year. It also opened two Market supermarkets – its new compact store format – and one Express store. The retailer also launched its private label brand 'Sabor e Qualidade' with the view to driving presence in fresh food over the next two years.

Noël Prioux, CEO of Grupo Carrefour Brasil, said the company had secured “another strong quarter” which was a “particularly satisfying performance, given the difficult environment” - referencing food deflation trends in the country.

Prioux said Carrefour Brasil would continue implementing its 2022 transformation plan, which involved expansion and investment in opportunity areas.

“We are on track to achieve our full-year targets of opening 20 Atacadão stores, making further advances in our digital and omni-channel strategy and enhancing our focus on our own-brand and organic products, which will drive future growth and further enhance our profitability.”

Atacadão – from strength to strength

Store expansions, particularly the Atacadão rollouts, generated 3.9% more sales in Q2 sales and 3.9% more in H1. Net sales in Atacadão stores alone were up 8.3% in Q2 and represented more than two-thirds of total sales.

Atacadão stores currently represented 179 of Carrefour's total 644-strong network in Brazil.

Roberto Mussnich, CEO of Atacadão, said the stores had been “strong and consistent” in Q2.

Such success, despite the deflationary environment, was due to Atacadão's “unique model with absolute leadership in prices in all segments”, as well as an efficient set-up, Mussnich told investors in the company's Q2 earnings call.

The expectation for the second half of 2018, he said, was for growth to continue by maintaining the current business model but introducing new automatic checkout systems. The high-speed systems would first be tested in the São Paulo Atacadão store.

E-commerce boom

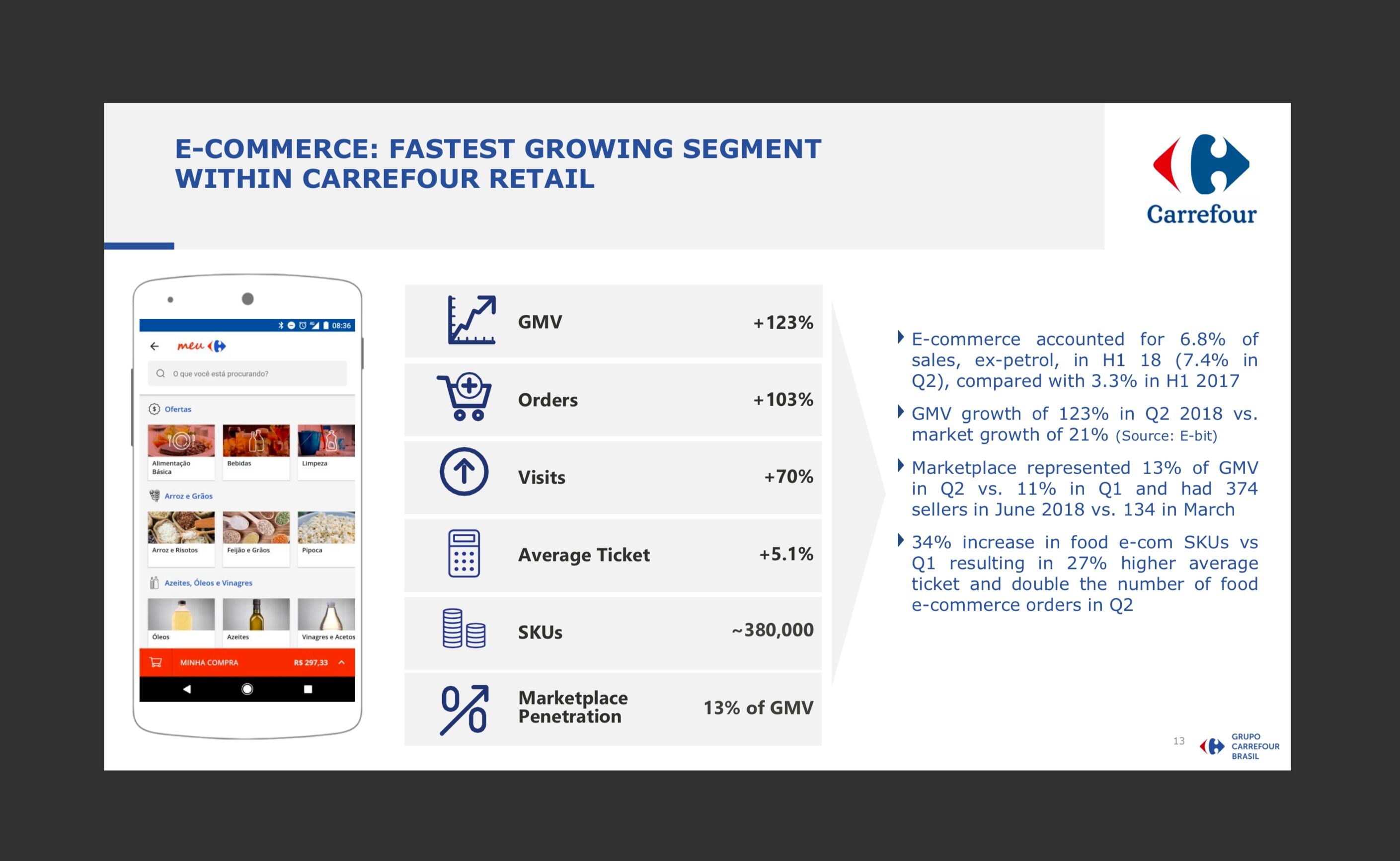

Carrefour Brasil grew its e-commerce gross merchandise value (GMV) or gross revenue for the channel by 123% in Q2, with the segment generating 12% of overall sales for the company.

Paula Cardoso, CEO of Carrefour Soluções Financeiras, said food and non-food e-commerce continued to be the “fastest-growing segment within Carrefour Retail”, representing 6.8% of total H1 sales, excluding petrol, but noted Carrefour Brasil only launched food e-commerce this year.

“It's still a startup that has been growing significantly, strongly, but it still obviously has a lower ticket, while the non-food operation has been going on for 12 months, so it's more mature,” Cardoso said.

According to the company, online food orders doubled in Q2 and SKUs in food e-commerce were up 34% from Q1.

Cardoso said Carrefour would continue to invest in its food e-commerce platform, learning from more-established models in France.