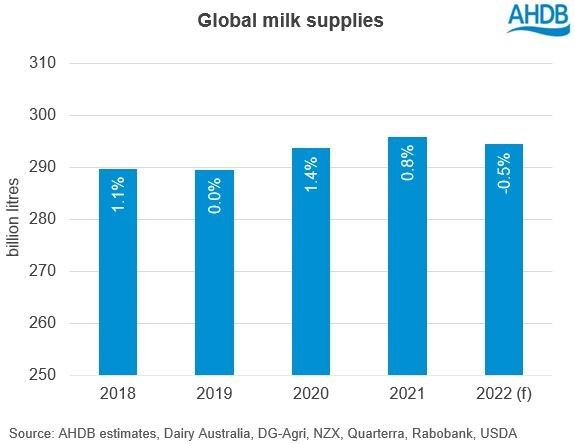

Global milk deliveries continued to record a year-on-year deficit in May – and there is slim chance of a turnaround for the rest of the year, forecasts from AHDB reveal.

According to the latest projections for the key milk producing regions, global production looks set for a decline of 0.5% on the year for 2022. This is a reduction from April’s forecast, where production was expected to remain stable on the year, AHDB said.

Regional breakdown: Biggest declines expected in Europe

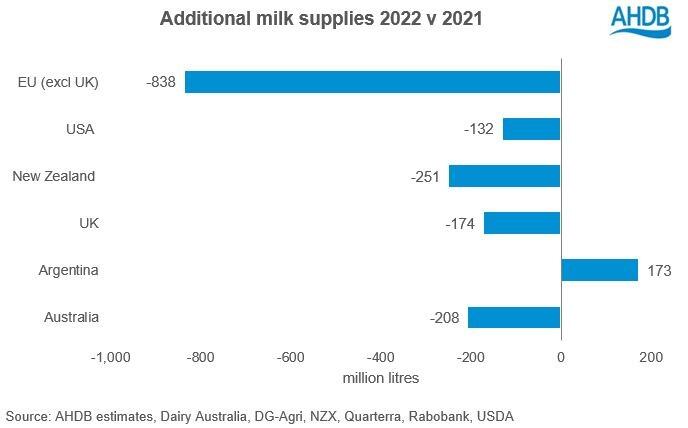

The expected decline in the EU is steepest globally. In volume terms, EU production now looks set to fall by 838m litres from 2021 levels. “Lower grass quality due to hot, dry weather and lower feed use due to lack of availability and increased cost are the main drivers. These drivers are also expected to decrease milk fat and protein content, reducing the availability of milk solids for processing,” ADHB noted.

In the UK, milk deliveries are also behind last year’s volumes, with GB deliveries specifically performing lower than anticipated. Production in Northern Ireland had started the year with strong growth; however, this has now eased and so forecasted growth for the region has now dropped to an annual decline of 1.2%.

After a worse than anticipated start to 2022, Australia and New Zealand are both now forecast to record year on year declines: -2.4% and -0.7% respectively. “This is despite the seasonal peaks still to come, as any volume gains in H2 2022 aren’t expected to outweigh those lost in H1.”

The US is anticipating a ‘small’ drop in production on slower than expected growth in yields. Meanwhile, Argentina is breaking the trend and is expected to continue to see year-on-year growth, although at a slower rate than last year as farm finances become less favourable.

Inflationary pressures outweigh high prices

“With no sign of inflationary pressures on input costs easing, farmers do not feel encouraged to improve yields despite the current strong milk prices. Add to this the ongoing challenges of labour shortages, transport delays, increased greening requirements and unfavourable weather, and the feasibility of increasing production in the short term looks doubtful,” the agricultural experts noted.

“The tight supply situation does provide support to dairy prices, although demand may be dampened when the large price jumps flow through to consumers. This is starting to be seen with lower retail sales in GB, a situation which is likely also occurring in EU and US markets.”