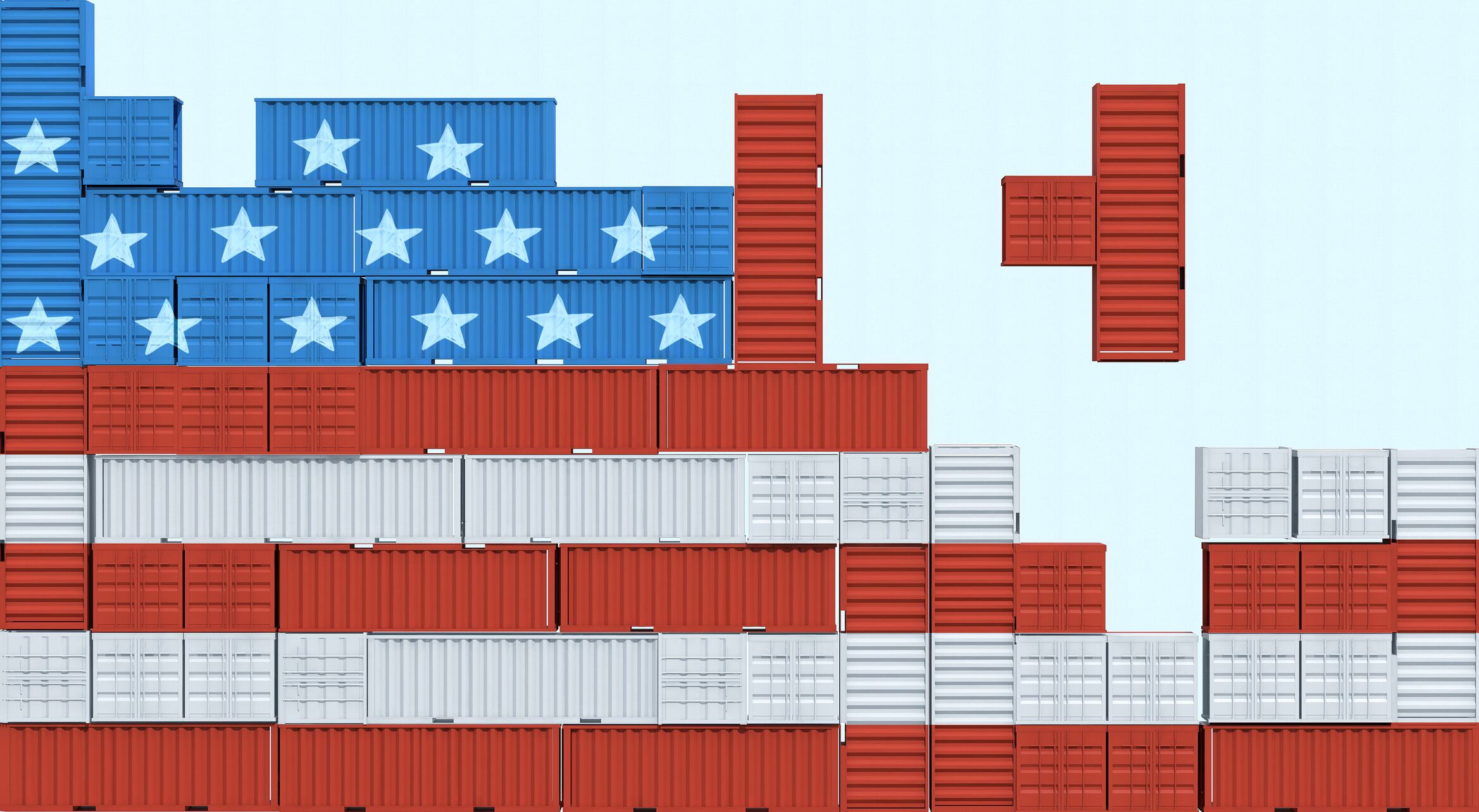

US president Donald Trump’s ‘custom tariffs’ came into effect on April 9, seeing the EU burdened with a 20% tax on all imports to the country.

The president’s baseline 10% tariff, which has been applied to the UK and other countries, came into effect on April 5.

Companies across Europe have had little time to prepare for the impact, but exporters across the food and agricultural chain, including potato processors, cheese makers, chocolate manufacturers, beer brewers, wine makers and distillers, now know that their exports to the US will face a 20% import tariff.

US stockpiling tariff-free products

“We see that companies have already anticipated this, such as through increases in inventories in the US,” says senior sector economist Thijs Geijer at European bank ING.

“This gives companies some room to manoeuvre in the short term.”

Some US consumers have also started to buy double and more of certain products in anticipation of the negative effects caused by the tariffs. Some commentators are likening the situation to the Covid-19 pandemic, where shoppers stockpiled.

Products expected to be bought up include coffee, wine, rice, meat and spices. There’s also an expectation consumers in the States will cut back on luxury items.

The move by US businesses to stockpile EU food and drink prior to the enforcement of tariffs was also a reinforced call from the food industry to continue with trade agreements, he added.

“European producers are in a stronger position compared to American competitors in terms of exports of products such as frozen fries to Mexico and pork to China.”

However, the global producers were unsure of the duration and complexity of the tariffs and therefore unable to plan far enough ahead.

“Before taking further steps, companies will want to know what countermeasures the EU and other US trading partners will come up with,” Geijer added.

Though the European Commission will introduce a series of countermeasures in mid-April, aimed at offsetting the US’s 25% steel and aluminium tariffs.

How will the EU respond to Trump’s tariffs?

These will be followed by additional packages in response to the new 20% tariff that came into play on April 9.

“Some product-specific countermeasures – such as increased tariffs on bourbon – will not cause much economic damage in the EU,“ said Geijer.

“But it will be painful if such a move provokes a reaction from the US, such as in the form of a 200% tariff on EU beverages.”

However, if the EU imposes US soybean tariffs, the main US agri export to the bloc, US farmers will be wounded and will plant less soy this year.

“At the same time, however, it will also hit the European animal feed industry and drive-up feed prices for livestock farmers,” added Geijer.