The data gathered from 6,000 respondents across the United States, Europe and Asia queried in November 2024 highlight an evolving global attitude toward sleep, presenting the preferences of a growing sleep-needing segment and increasing opportunities for targeted solutions.

1. Sleep ahead of longevity and stress

Lumina findings that 54% of consumers surveyed identified better sleep as their top health goal align with broader World Health Organization (WHO) data showing that nearly one-third of the global population suffers from inadequate sleep either due to problems falling or staying asleep.

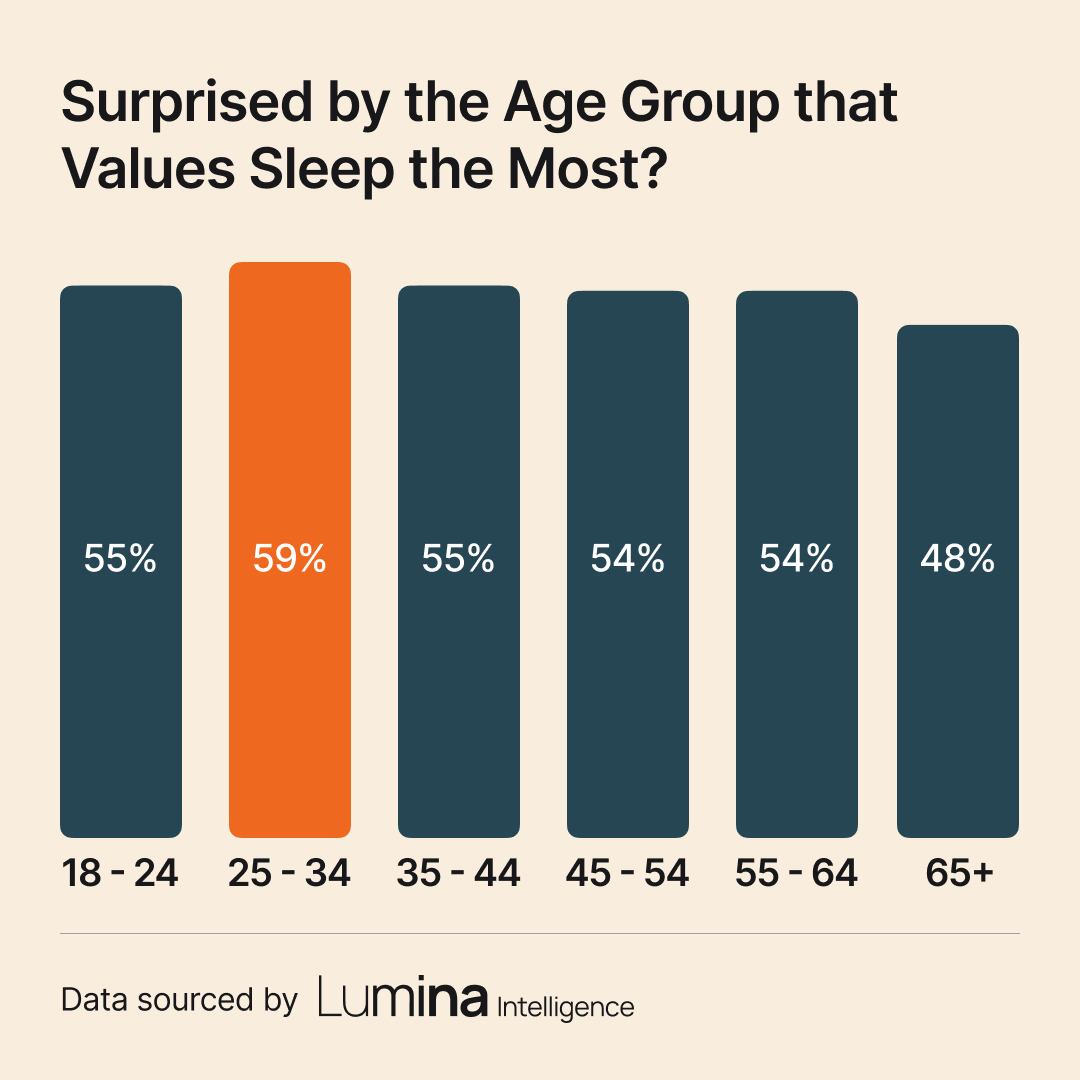

2. The sleep appeal across the lifespan

While the survey noted that the importance of sleep peaks in younger Millennials, over 50% across almost all age groups prioritize a good night’s rest. Surprisingly, the 65-and-older crowd—often more susceptible to sleep disruptions due to a combination of physiological, psychological and lifestyle factors—logged the lowest percentage of all age groups.

3. How does health tracking fit in?

Consumers are increasingly using health tracking tools to gain personal insights that encourage healthier habits. Although nearly 40% of consumers report not using these apps, both average users (34%) and more dedicated ‘better sleep’ consumers (39%) actively engage in fitness tracking. The data also shows that both groups track overall wellness, diet, mind and mood, and ovulation at similar rates.

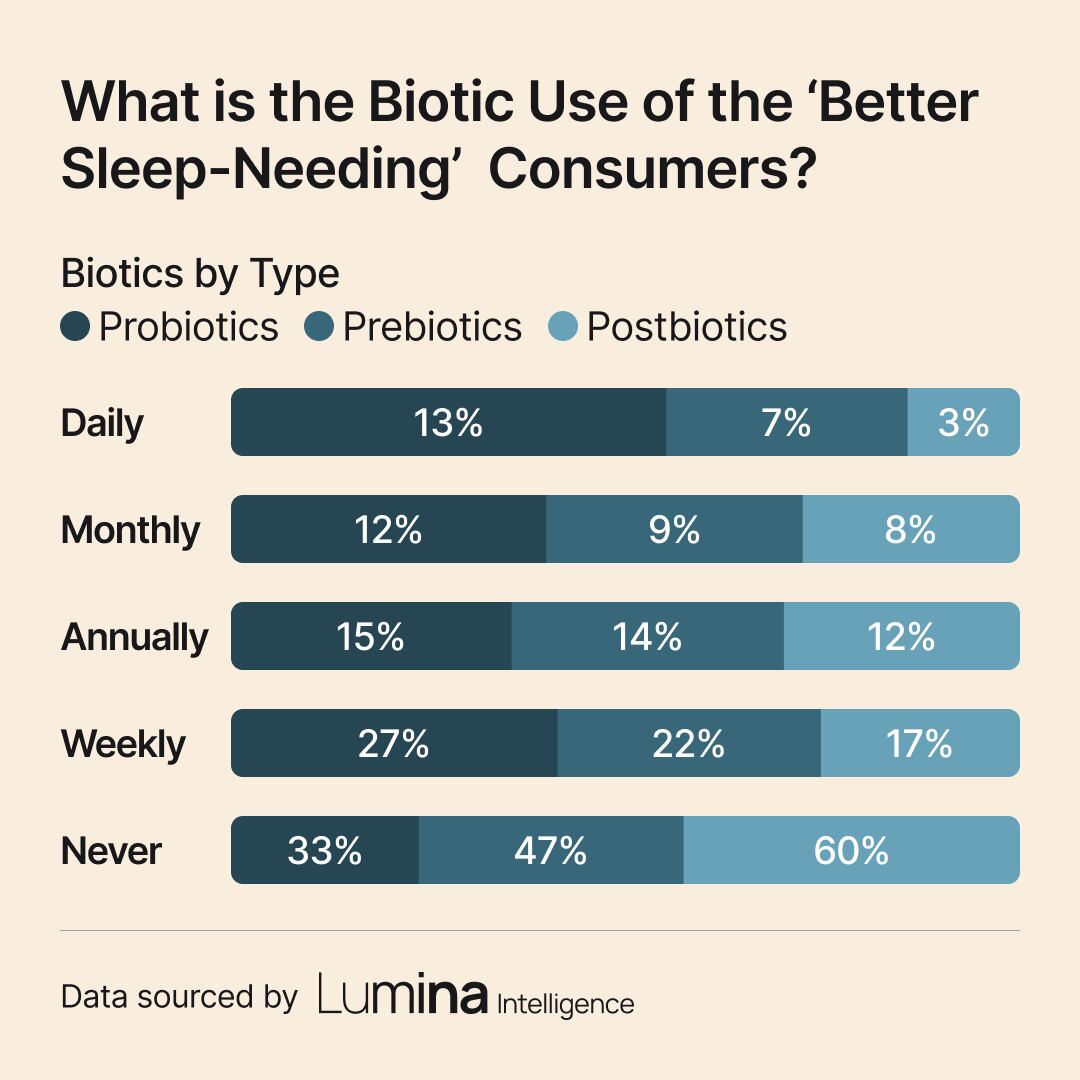

4. The gut-brain sleep connection

Consumers who say they are in need of better sleep are turning to biotics—more so probiotics and prebiotics than postbiotics still. According to the data, 27% of individuals report using some form of biotic supplement at least a few times a week, however a larger percentage never use a biotic. Emerging interest aligns with emerging research on the gut-brain-sleep connection, which suggests that a healthier gut microbiome can positively influence sleep quality by regulating mood, stress response and even melatonin production.

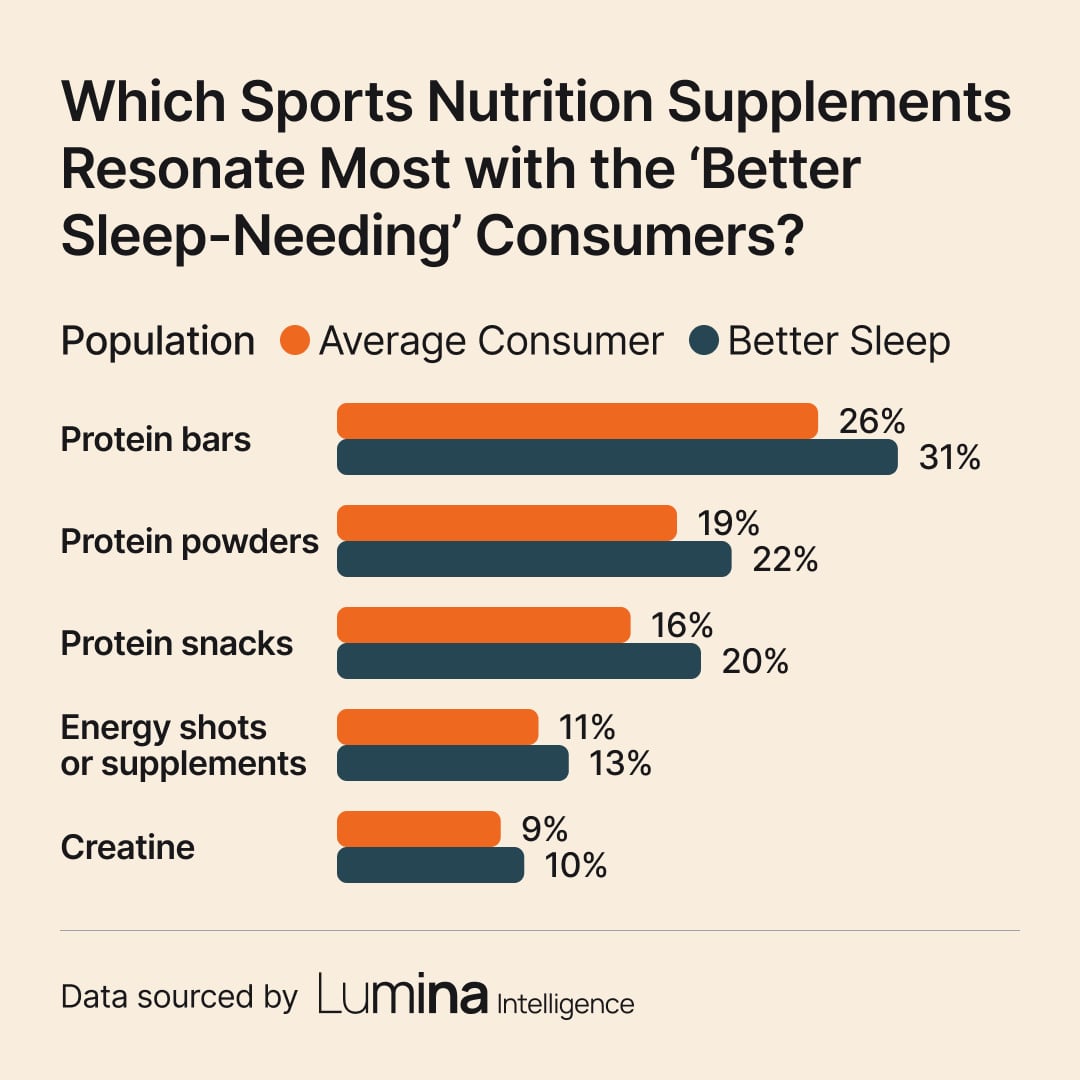

5. Sleep seekers trending towards protein

Survey findings reveal that ‘better sleep-needing’ consumers are engaging with sports nutrition products, particularly protein-based offerings, at a higher rate than the average consumer. Protein bars, powders and snacks topped the list, with this cohort consistently over-indexing by a few percentage points in each category. Energy shots and creatine also showed stronger appeal among these consumers, who selected from a list that also included beta-alanine, botanicals, BCAAs, electrolyte/hydration supplements, glutamine, nitric oxide boosters, pre-workout powders and an ‘other’ sports supplement category.