“It’s been an incredible journey since spin.” With those words, WK Kellogg CEO Gary Pilnick captured the stakes of the company’s transformation – and the challenge that lies ahead.

Nineteen months after separating from its former parent company, WK Kellogg is no longer simply managing a legacy cereal business. It’s trying to reinvent one. And it’s doing so under pressure: sales are slipping, tariffs are biting and the once-reliable cereal aisle is now in existential flux.

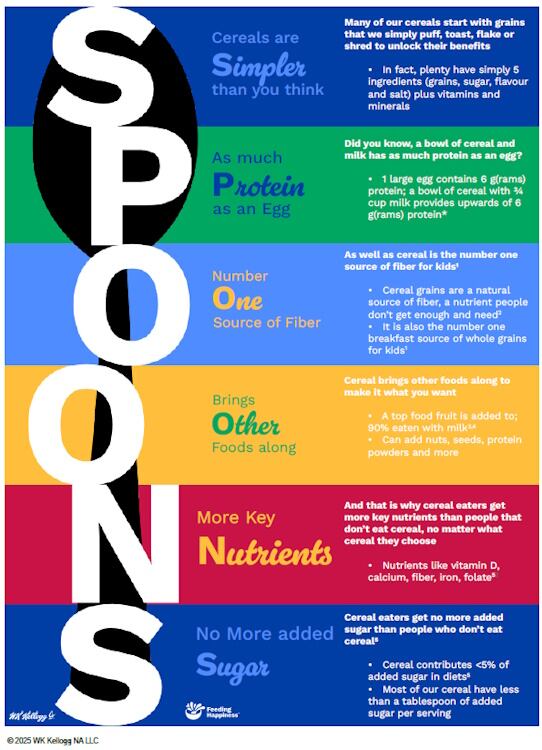

In response, the Battle Creek-based company has launched a high-profile campaign centred on health and wellness – with SPOONS as its flagship framework. The goal: reposition cereal not just as breakfast, but as a modern, nutrient-packed wellness food.

A new story for an old food

SPOONS – which presents cereal as Simple, Protein-rich, the number One source of fibre for kids, complements Other nutritious foods, helps cereal eaters get more key Nutrients than non-cereal eaters and doesn’t contribute to higher added Sugar intake – was rolled out earlier this year at the Consumer Analyst Group of New York (CAGNY) conference.

“Much of what’s true about cereal is misunderstood,” Pilnick said on the Q1 earnings call. “Our SPOONS framework tells that story: cereal can be simple, high in protein and fibre, with no more added sugar than those who skip it altogether.”

That messaging shift comes at a critical time. In the first quarter of 2025, WK Kellogg reported a 6.2% drop in net sales to $663 million and a 45.5% plunge in net income, falling well below analyst expectations. Organic sales were down 5.6%, driven by an 8.6% slide in volume, despite a 3% boost in price/mix.

Investors reacted sharply. Shares fell nearly 11% following the earnings release, prompting fresh questions about the company’s post-spin direction.

Still, Pilnick remained upbeat. “It’s not the start to the year that we planned for,” he acknowledged, “but we are advancing with urgency and purpose to meet the evolving needs of our consumers.”

From slump to strategy

WK Kellogg plans to bring its SPOONS framework to life through media campaigns and product relaunches, focused on three key areas to make its portfolio stand out as a health-forward choice in the competitive breakfast market.

“First, simplicity. Many of our cereals start with just four simple ingredients before adding vitamins and minerals,” said Pilnick. “We are launching a new media campaign and updating front of pack claims to share this message, featuring key brands such as Frosted Flakes, Corn Flakes, and Rice Krispies.

“Second, protein. Kashi is one of the pioneer N&O [Natural & Organic] brands, which offers great tasting food, high quality ingredients and inherent health benefits – exactly where you want to be within this current consumer landscape.”

Kashi had languished under its former parent but is now poised for a resurgence, said Pilnick. Improvements in supply and profitability have paved the way for a “substantial step-up” in commercial support.

“Prior to the spin, it was managed separately within the broader Kellogg Company and often deprioritised. Now, as part of WK, we have simplified recipes, improved supply and profitability of the brand portfolio has improved. We are now shifting our focus to demand generating activities and increasing commercial support to levels that the brand has not had in years.

“Representing approximately 50% of the franchise is Kashi Go, which we are now relaunching with new food, an improved packaging design and a larger pack size offering. Kashi Go now delivers consumers the unique benefit of 10 grams of protein and 10 grams of fibre, with single digit sugar. This is the type of food that should resonate well with our health-focused consumers.”

Meanwhile, Special K – once the go-to brand for weight-conscious consumers – continues to struggle despite its health-forward legacy. The brand lost another 40 basis points in Q1 share. Pilnick said upcoming messaging (especially around fibre) would sharpen focus on the brand.

“Cereal is the number one source of fibre for kids and we know many people don’t get enough of this essential nutrient. Many of our cereals provide an excellent source of fibre and we are bringing that message to life through a new multi-brand campaign launching later in Q2.

“You can see how these consumer trends and our activities behind them would serve as a tailwind for our topline performance going forward.”

Ferrero interest adds strategic intrigue

While WK Kellogg remains focused on its organic strategy, it has also found itself in the sights of potential acquirers.

Earlier this year, Ferrero was reported to be exploring a possible acquisition – part of the confectionery giant’s push to expand deeper into the US breakfast space. Talks never progressed to a formal bid, but Ferrero’s interest certainly sparked intrigue about the future direction of the company.

Some shareholders, sources say, remain open to strategic alternatives should the SPOONS-led transformation fail to produce results by 2026.

Adding to the pressure are escalating input costs and tariffs tied to the Trump administration’s Liberation Day trade push. CFO David McKinstray said WK Kellogg expects a $2-$4 million earnings impact in 2025 due to raw material sourcing outside North America.

While most production remains shielded by USMCA (US-Mexico-Canada Agreement) exemptions, the threat of further disruption hangs over the company’s carefully calibrated supply chain.

At the same time, margin recovery is essential. McKinstray reaffirmed the company’s goal of expanding margins by 500 basis points by the end of 2026, a feat that will require both internal efficiencies and a topline rebound.

Will SPOONS make cereal cool again?

The bigger question is whether the framework can actually rewire public perception and drive demand in a category that’s steadily lost relevance.

The positioning is certainly timely with consumers increasingly seeking out high-protein, high-fibre, low-sugar foods. The clean label narrative also plays into the FDA ban on petroleum-based dyes. But cereal isn’t just competing with toast anymore – it’s up against snack bars, smoothies and functional beverages that promise both wellness and convenience.

“We’re operating in a category that our founder created,” Pilnick said. “One that is at the intersection of value, nutrition and taste – what we call affordable, healthy joy.”

It’s a compelling pitch. But with earnings lagging, investor unrest percolating and a potential suitor waiting in the wings, the company has little room for error. For WK Kellogg, SPOONS may be its final chance to spoon-feed cereal into a new generation’s routine before someone else takes the bowl.

Q1 2025 earnings highlights

• Net sales: $663 million (-6.2% YoY)

• Organic Net Sales: -5.6% (Volume -8.6%, Price/Mix +3%)

• Net Income: $18 million (-45.5% YoY)

• EPS: $0.20 (vs $0.40 expected)

• Adjusted EBITDA: $72 million (-4%)

• Adjusted EBITDA Margin: 10.8% (+ 20 basis points)

• Free Cash Flow: -$62 million

Updated FY2025 guidance:

• Organic net sales expected to decline 2%-3% (vs 1% prior)

• Adjusted EBITDA expected to be flat to down 2% (vs 4%-6% growth prior)