The retail major pulled in consolidated net sales of R$12.7bn (US$3.4bn) for the third-quarter (Q3) of 2018, up 8.1% on the previous year, and reported an adjusted net income rise of 67.6%. Like-for-like sales in Q3 grew 5.1%, the highest growth rate since Q1 2017, with expansion of Atacadão accounting for a further 4% sales growth.

In the quarter, Atacadão alone pulled in net sales of R$8.6bn (US$2.3bn), up 11.4% on the previous year, “attesting to the strength of its commercial model”, Carrefour Brasil said.

Driving Atacadão expansion to 20 new stores

Back in August, Carrefour Brasil said it would double its Atacadão wholesale hypermarket footprint this year, opening an additional ten stores.

Already well underway with expansion plans, the retailer opened four new Atacadão Cash & Carry stores in Q3, including one conversion of a Carrefour hypermarket; two Market; and three Express stores.

“Our expansion strategy continues to favor high-return formats with a greater emphasis on Cash & Carry (…) At the end of September, Grupo Carrefour Brasil's total store network reached 652, of which 185 are Atacadão stores (160 stores and 25 wholesales).”

The retailer said it would open a further six traditional-format Atacadão stores by the end of this year, driving new store openings to 20 in a single year “for the first time ever”.

“The contribution of expansion has increased consistently every quarter this year, as a result of our decision to accelerate openings to 20 new stores per year, from 10-12 stores previously,” it said.

Food at home recovery and e-commerce boom

Carrefour Brasil said all of the Q3 solid sales growth had happened in the context of a“reversal of the food deflation trend”.

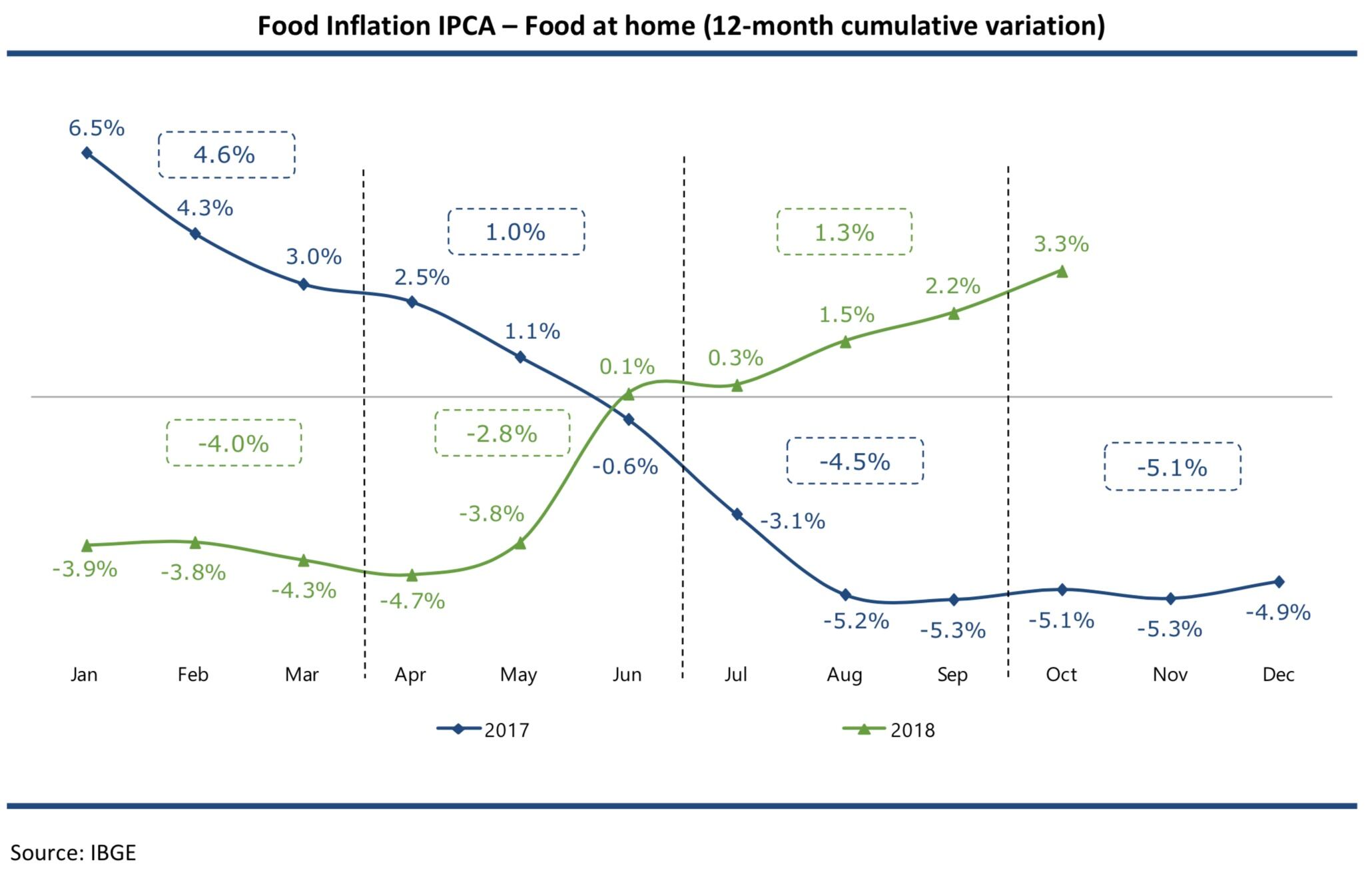

After four consecutive quarters of ongoing deflation, it said Brazil's National Wide Consumer Price Index (IPCA) showed the Food at Home index was finally moving to inflation, up an average of 1.3% compared to -2.8% in Q2 and and -4% in Q1.

Carrefour Retail saw like-for-like growth up 3% for Q3, driven by an improving trend in hypermarkets but also a particularly strong performance in food e-commerce – a segment that accounted for almost 7% of Carrefour Retail sales for Q3, up from just 3% the previous year.

“Food e-commerce sales improved sharply, helped by a greater number of SKUs and average ticket,” the retailer said. The number of food e-commerce orders was up 61% year over year, it said, fueled by Carrefour's same-day delivery service and two-hour delivery window for customers. Click & Collect had also proved popular.

“Ongoing initiatives within the framework of the 'Carrefour 2022' Transformation Play, combined with further development of our omni-channel strategy, helped to boost sales performance in all businesses in Q3, reinforcing our leadership position in Brazil,” the retailer said.