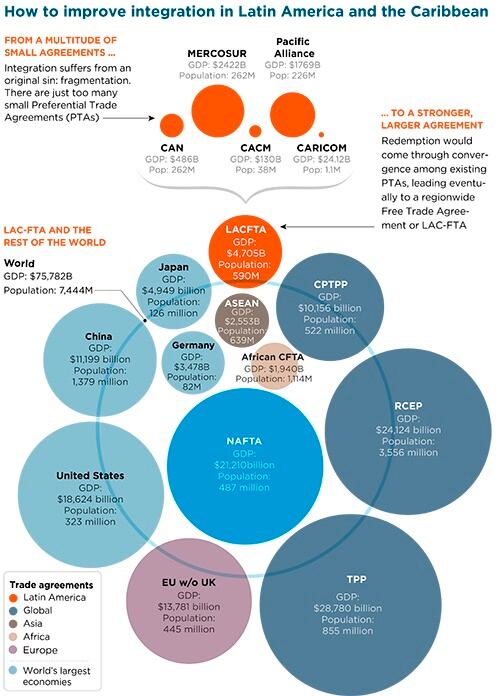

In a special report on integration and trade by the IDB Connecting the Dots – A Roadmap for a Better Integration of Latin America and the Caribbean, the bank outlined how Latin America and the Caribbean could, and should, form a single free trade market called 'LAC-FTA'. Creating such an agreement, IDB said, would increase intraregional trade in all goods by an average of 3.5% and provide an additional $11.3bn of trade flow for the region. Under such an agreement, Mexico would increase intraregional exports in manufacturing by 8% and Central America would see a 21% rise in intraregional trade in agriculture.

Mauricio Mesquita Moreira, chief economist for trade and integration at IBD, said all of this could have a hugely positive economic impact on a region in a global setting.

“We're not talking about a big boom, it's a low-hanging fruit that if you move towards convergence you can get substantial gains. In this context of trade conflict and the fact traditional trade has been crawling, 3.5% doesn't sound that small. It's shifting the level and will repeat every year,” Moreira told FoodNavigator-LATAM.

Getting out of a 'tangled mess'

All of this was particularly important and relevant, he said, given the backdrop of Latin America failing to compete in the global market with current preferential agreements, many of them bilateral.

Over the years, LATAM had established a number of agreements, including significant ones like The Pacific Alliance and MERCOSUR, Moreira said, along with more than 30 smaller but still substantial preferential trade agreements (PTAs). But, he said they hadn't proved as powerful, from an economic perspective, as planned – none had boosted exports to the rest of the world.

“These agreements are very small. They don't have enough physical mass to generate the type of gains they were looking for. Fragmentation was pretty much a big problem if you really wanted to get some momentum in terms of economic scale and being competitive abroad. If you really want to make these agreements relevant, especially in the current world economy, you need to get more of a critical mass, otherwise they're going to become irrelevant.”

Even The Pacific Alliance, which had good press overall, had not achieved significant increases in global trade, he said, and the rest was a “tangled mess”.

“The bright side is you have almost 90% duty free trade but at the same time you have this 'spaghetti bolo' of agreements which has incredible costs for enforcement and compliance.”

By blending these agreements and going beyond current terms, he said there was “clearly a gain to be had”, especially in food and agriculture. Many, for example, did not currently cover agriculture and food inputs and therefore a broad, intraregional agreement could spark a lot of positive change, he said.

Agriculture was also “most affected” by non-tariff barriers in Latin America, he said, which, if broken down via a single agreement could give a “big boost for food value chains in the region”.

Mexico, Brazil & Argentina – 'the big three'

However, change could only be achieved with the involvement of “the big three” - Mexico, Brazil and Argentina, Moreira said, especially for positive change in the food business because Brazil and Argentina were major agri-food producers.

The three countries, he said, were already talking to renegotiate current agreements and so knew current political and economic positions which would help speed up negotiations of a single free trade market.

“If you think about the most ambitious thing – the free trade area – then, you know, it could take no less than three to four years to negotiate. And, of course, there would be a phase-out for this to be implemented, with enough flexibility for things to happen.”

But, Moreira admitted it would be no easy task and even the concept would likely be met with resistance from parts of the region, particularly Mexico.

“The problem is that Mexico is very skeptical of the free trade reputation in Argentina and Brazil...When you talk to Mexicans, they say these countries are not reliable, there's no political consensus, the government changes, policies will change. So, it's a hard sell in that sense.”

Although, he said with all the current issues around the NAFTA agreement between the US and Canada, it could tip Mexico towards considering a LATAM-wide agreement more seriously.

“...For Mexico, particularly, I think it would be a total win-win. Especially in this context that they're re-negotiating NAFTA. But even before that, they had this trade diversion going on between the US – they already paid the adjustments because local producers were being displaced by US imports. By allowing Argentinian and Brazilian products to come in, they would increase competition to US producers and probably lower prices without too much damage to local producers,” he said.

There isn't much time...

A single free trade agreement could be achieved and had to be done quickly, Moreira said.

“We have to think of a free trade zone as something more like to guide initiatives of the government,” he said, that was “very light in terms of institutions” and more of a mechanism for ministers to utilize.

“It's been more than 50 years, half a century, of integration talk. It's about time to get something that really makes an impact...We totally realize that's not going to be easy. At the same time, you already have this network of agreements that gives a base to build on and, you know, the political cycle might favor some sort of initiative in that direction when you talk about 'the big three'. If the big three move, then I think it would become much more feasible to think about a scheme like this.”