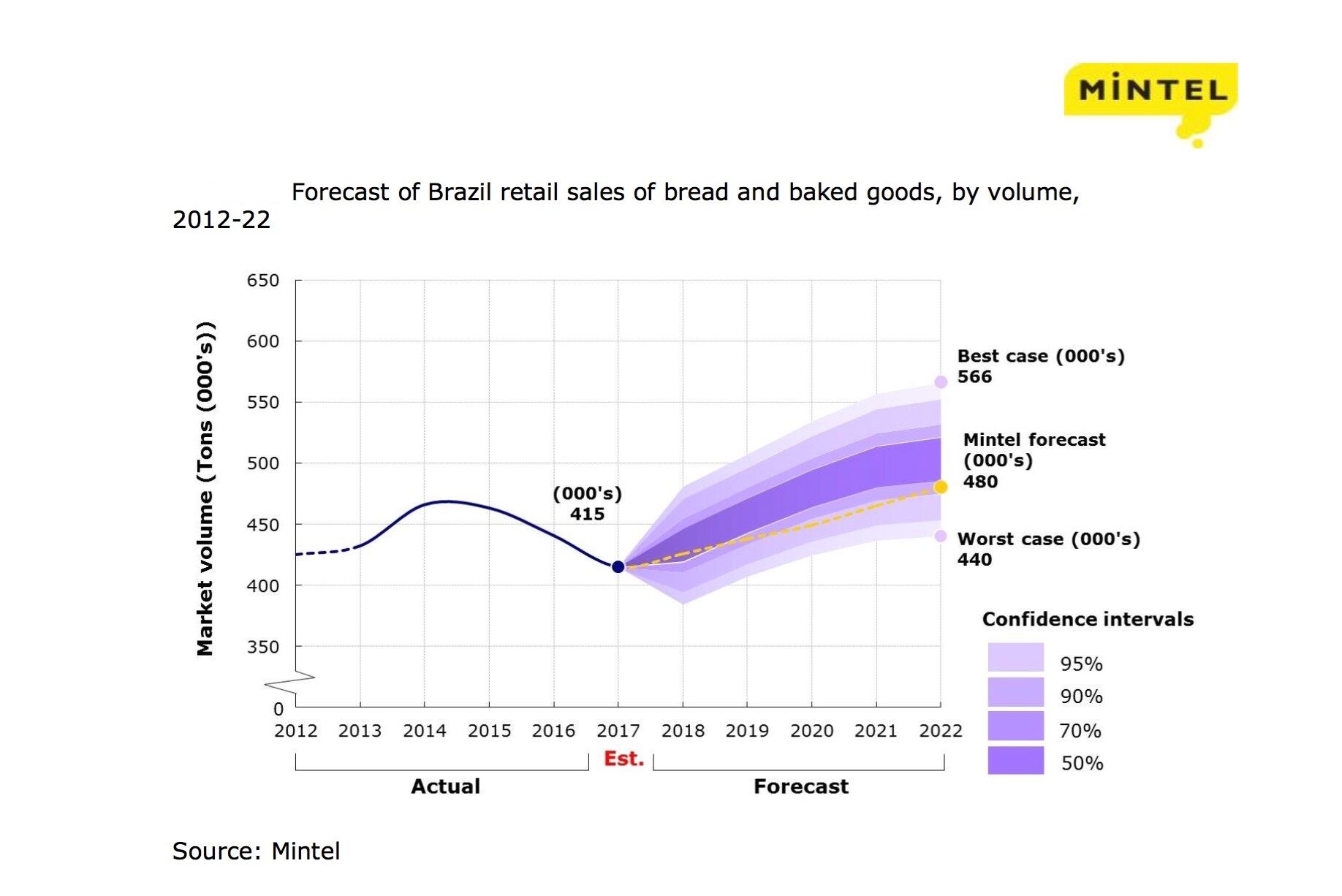

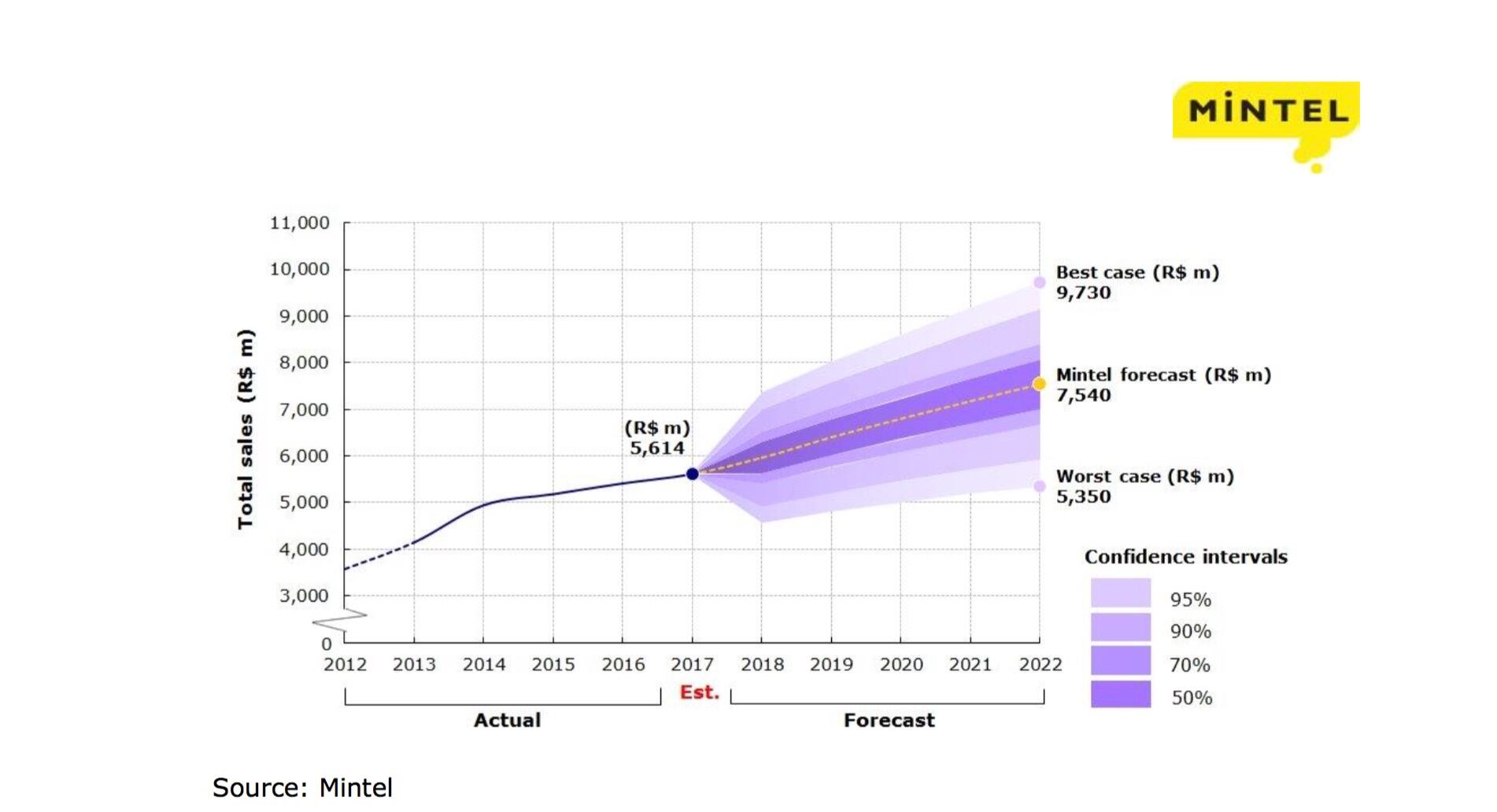

Last year, the market pulled in estimated revenues of $5.6bn – up just 3.7% on the previous year, according to Mintel’s Bread and Baked Goods Brazil 2017 report. Also, retail volumes were down 5.8% to an estimated 415,000 tons versus 441,000 in 2016.

Mintel said these retail volumes and revenues had been struggling since 2014, but thanks to a slow economic recovery in Brazil the category should see growth in 2018.

“As inflation rates fall, manufacturers can import ingredients such as wheat at better prices, which is expected to give more stability to the final prices of bread and baked goods,” Mintel wrote.

“In addition, decreasing inflation and the albeit slow economic recovery should improve the purchasing power of consumers and the category conditions for growth in terms of value.”

Mintel said revenues would likely rise to around $5.96bn for 2018 - up 6.2% on 2017 estimations - and grow steadily to $6.8bn by 2020. Volumes should also recover, soaring out of decline and into a 2.6% growth this year.

Packing healthy

This growth, it said, would likely be spurred by increased consumption of packaged goods, as opposed to fresh, as consumers seek out convenience and choice, particularly around health.

A Mintel survey of 1,500 adults aged 16+ in Brazil showed that 19% considered ‘all-natural’ to be an encouraging factor in the consumption of bread and baked goods; this was closely followed by 14% that said wholegrain would encourage them to eat more.

Mintel said manufacturers, especially leading brands, had been providing options like wholegrain, gluten-free and products with added nutrients that held strong appeal amongst consumers.

Grupo Bimbo, for example – Brazil’s market leader in bread and baked goods – had introduced a number of healthful lines under its brands: a ‘supreme’ line of wholegrain breads with Nutrella and a ‘QD+’ reduced sugar and wheat line under its Ana Maria brand that combined chocolate and natural ingredients.

Grupo Bimbo had posted a 6% volume (and value) growth in 2016, despite overall category volume decline and revenue stagnation.

Mintel said even through economic difficulties, consumers in Brazil were prepared to spend money on healthful foods – 28% bought the same products just from cheaper outlets, according to survey data.

Smaller convenience

Focused development around packaging was another way manufacturers could drive revenues and growth in the category, Mintel said, especially as it was an area that had seen little innovation so far.

“Since Brazilian families are getting smaller, with many couples living without children and people living alone, the demand for products with individual or smaller packages is likely to increase. However, the number of launches of products with smaller packages is still quite small in Brazil,” it said.

In 2016, there was a rise in the launch of 300g packages – which could be an alternative to traditional 400g and 500g packs – and there was a slight increase in 200g packs on the market.

In 2017, Wickbold – Brazil’s second biggest manufacturer in bread and baked goods – launched products in 200g, 250g and 300g varieties, but Mintel said product numbers were “modest” when compared to other launches.

Mintel said there was a clear demand for smaller packages, driven by a number of factors. Survey data showed 11% of consumers said it would help them avoid food waste and another 11% said it would help them cater to different tastes within the family.