Speaking to Lumina Intelligence’s ‘Sustainable Food & Drink Podcast’, Cathy Pieters, director of Cocoa Life, Mondelēz’s 10-year, $400m sustainability intiative, said: “Cocoa Life has not been setup as a marketing tool.

“When we setup Cocoa Life it was really a business decision…we were not able to grow our business on a weak supply chain.”

Cocoa Life on-pack

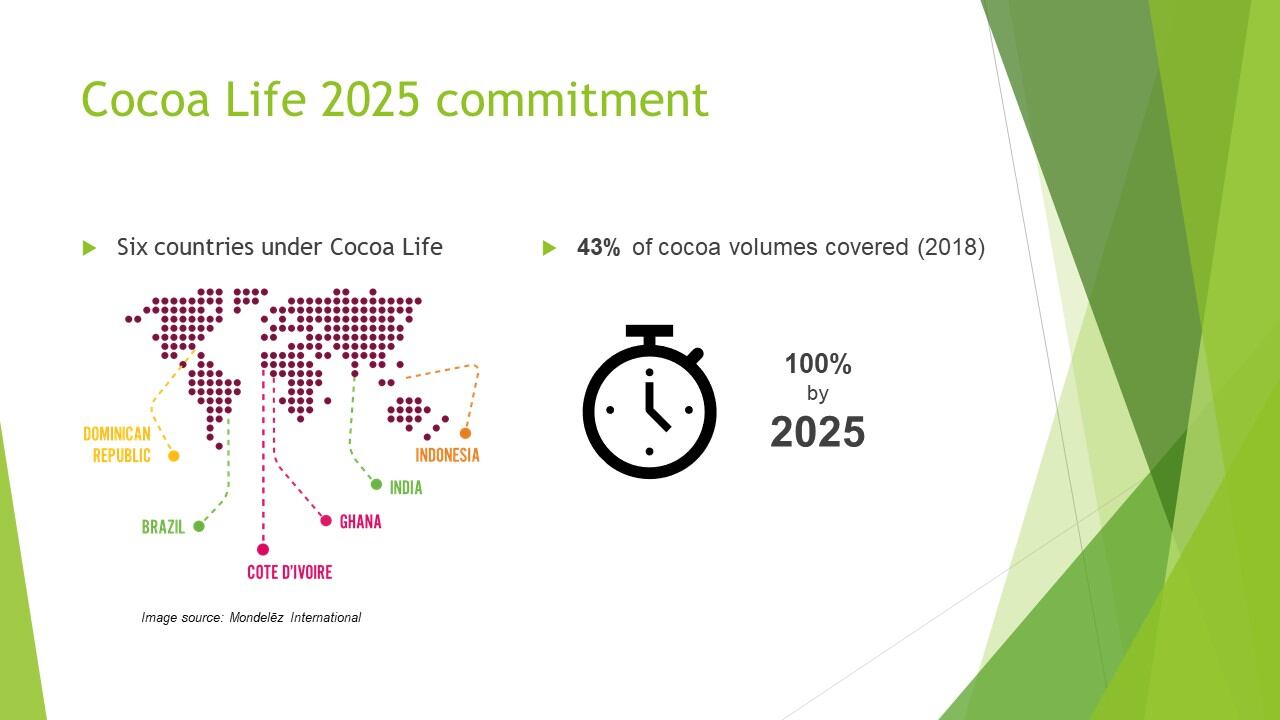

Cocoa Life volumes accounted for 43% of the group’s annual cocoa needs at the end of 2018, supplying eight Mondelēz brands including Cadbury Dairy Milk and Milka.

The company aims to source 100% Cocoa Life for all brands by 2025.

Brands sourcing from Cocoa Life make an on-pack claim using the Cocoa Life logo and occasionally say the cocoa is “100% sustainable”.

According to Lumina Intelligence Sustainability, 17% of Mondelēz’s bestselling chocolate countlines and tablets brands online across 20 countries make a Cocoa Life claim on pack or in online product descriptions.

“It’s one way to signal to consumers this is sustainably sourced,” said the Cocoa Life director.

Are sustainable claims acceptable while poverty persists?

But is there a dilemma in claiming chocolate sustainable when farmers are still far from a living income?

“It’s okay to state as a company that we know the people we’re working with and that we’re working together over time to get to sustainable livelihoods,” said Pieters.

Industry standard sustainability claim?

Lumina Intelligence’s report 'Up to standard: Third-party certification and company programmes compared' encourages companies to get behind an industry wide ISO sustainable cocoa claim as conventional fair trade claims have niche appeal and generate low consumer engagement.

But she added: “We probably need to think about a broader, long-term, sector-wide sustainability strategy that’s supported by coordinated action, otherwise we’ll not get there.”

Pieters said Mondelēz was responding to consumer demand for transparency by including a link to the Cocoa Life website on-pack that includes an interactive map of Cocoa Life locations and impact assessments.

“We work with Ipsos as an independent body to go out into the field and measure on our 10 global KPIs the impact progress,” she said.

Incomes in Cocoa Life

Ipsos provides impact reports on the 10 KPIs to Mondelēz for each origin annually, but Mondelēz has final say on what’s made public.

Ipsos came on board in 2017 after Mondelēz severed ties with Harvard University. Harvard was appointed in July 2014 to report on social impact of Cocoa Life every three years.

Cocoa Life’s first impact report, published in 2016 based on Harvard data, said annual farmer income in Ghana had risen from around 1,000 Ghanaian Cedi ($183) to nearly 3,000 cedi ($550).

This equates to $1.50 a day or $0.25 per person for an average household of six.

Mondelēz’s latest impact report, published in April this year, said incomes from cocoa for Cocoa Life farmers in Ghana grew 6% in some regions from 2015 to 2018 and declined 26% in other regions.

It did not report income in Ghana Cedis or US dollars.

The company has previously published income data for Indonesia, but not for the other Cocoa Life countries: Côte d’Ivoire, Dominican Republic, Brazil and India.

How is income calculated?

To calculate income, France headquartered market research firm Ipsos follows a panel of farmers and communities over three years, before selecting a new sample for the next three years.

The panel is selected from complete lists of Cocoa Life farmers in all origins using probability sampling so it is a representative sample, according to Ipsos.

Ipos staff use Computer Aided Personal Interviewing (CAPI) platform iField to survey farmer households, including the farmer, their spouse, as well as community leaders.

Meghann Jones, senior vice president of global affairs at Ipsos, told us: “Prior to this year we asked gross cocoa and non-cocoa income from Cocoa Life program participants.

“From this year we are calculating net income (i.e. we are now factoring in the costs of cocoa production). We have also added a passbook/receipt verification step.”

Industry reporting on incomes

Mondelēz, Barry Callebaut and Hershey are among the few companies with a commitment on cocoa farmer income. Most companies tracked by Lumina Intelligence Sustainability have no pledge or a public key performance indicator (KPI) on cocoa farmer income.

Even among the three companies the level of reporting on income is varied and limited to certain geographies. The proportion of cocoa farming household under a company programme living under $1.90 a day and actual household income is in US dollars is very rarely reported.

Yields continuously improving

Asked about the impact achieved by Cocoa Life since its 2012 launch, Pieters said: “We have seen positive impact specifically in farmer cocoa yields, which we see continuously improving, but also in communities being empowered to steer their own development.

“We also know form our impact the farms are not infringing on protected forests.”

Cocoa Life’s website claims farm yields are typically above national averages It reports +15% in Ghana vs. non-Cocoa Life farms

Country-wide average yields in Côte d’Ivoire declined 9% from 2012 to 2017 to 0.49 MT per hectare, according to FAO data, and 5% in Ghana to 0.52 MT.

Asked if incomes had improved as a result of yield gains, Pieters said: “We see different results in the different countries and even when we see income increases there’s no possibility to learn something from the average because the drivers are in some cases yield increases, in other cases price increases, in other cases they have been able to sell more cocoa [or have diversified revenues outside cocoa].”

She said providing farmers market access to the sell their cocoa with clear terms of trade on price, volumes and loyalty premiums was the key to better livelihoods.

Listen to the podcast for Mondelēz’s take on:

- Côte d’Ivoire and Ghana’s living income differential.

- Brazilian Amazon fires and Cocoa Life in Brazil

- The ISO sustainable and traceable cocoa standard

- Listen to free on-demand webinar for Lumina research findings and a Q&A with Cathy Pieters: COCOA SUSTAINABILITY: SELLING ETHICAL CHOCOLATE ONLINE WITH SDG IMPACT.

- SUBSCRIBE: Lumina Intelligence's 'Sustainable Food & Drink Podcast' on iTunes and Spotify.

Music credit: Blue Dot Sessions