For years, brand marketers have characterized millennials as a young generation that is "hyper-connected, care-free and self-centered", assumptions that have shaped new product development and marketing strategies, says Kantar Worldpanel.

However, millennials have grown up and the eldest members of this demographic group are now in their mid-thirties, with eight in every 10 millennial households in Latin America including children. This brings responsibilities that are shaping Latino millennials’ priorities, aspirations and purchasing decisions.

“In Latin America, 25% of housewives are under 34. Far from being free of responsibility, they have families, homes, careers and economic worries – and this affects what they buy, and how they buy it.

“It is extremely important that brands and retailers have a proper understanding of this vital shopper segment,” writes Kantar business analyst for the LATAM region, Cecilia Alva, in a recently published report, entitled Demystifying Millennial families in LATAM.

The spending power of Latin American millennials is also significant – they represent one-quarter of the Latin American population and account for 24% of total FMCG spend – meaning brands ignore the specificities of this demographic at their peril.

This spending power is estimated to be worth around US$30 billion, according to Kantar figures.

Highs and lows: The income divide

One characteristic of the millennial population in Latin America is the divide between high- and low-income households.

Two-thirds of millennial households are low-income families, compared with 56% across all demographics, and half of these have only one income, as 50% of millennial women do not work outside the home.

According to Kantar, this percentage is even higher in Argentina, Brazil, and Mexico.

Depending on the country, inflation, economic crises and the rising cost of consumer goods add to these financial pressures.

“One way they are managing [to deal with these pressures and reach their goals] is by eating out less in restaurants and ordering fewer takeaways, choosing to cook at home to save money and take prepared lunches to work instead,” writes Alva.

“The average millennial household says they cook on at least four days in the week, spending around one hour on the task, which means they want traditional meals that are quick to prepare.

"The chief cook is usually the housewife, but millennial husbands cook 50% more than the average across the Latam population, so brands should also be targeting men.”

Millennials continue to be digitally connected, according to the market research company. This is particularly true in Brazil and Argentina, where nine out of 10 use a cellphone – 5% more than the average.

Social networks continue to play a significant role, with Facebook, Instagram and YouTube the most popular channels in Latin America, that millennials log onto several times a day.

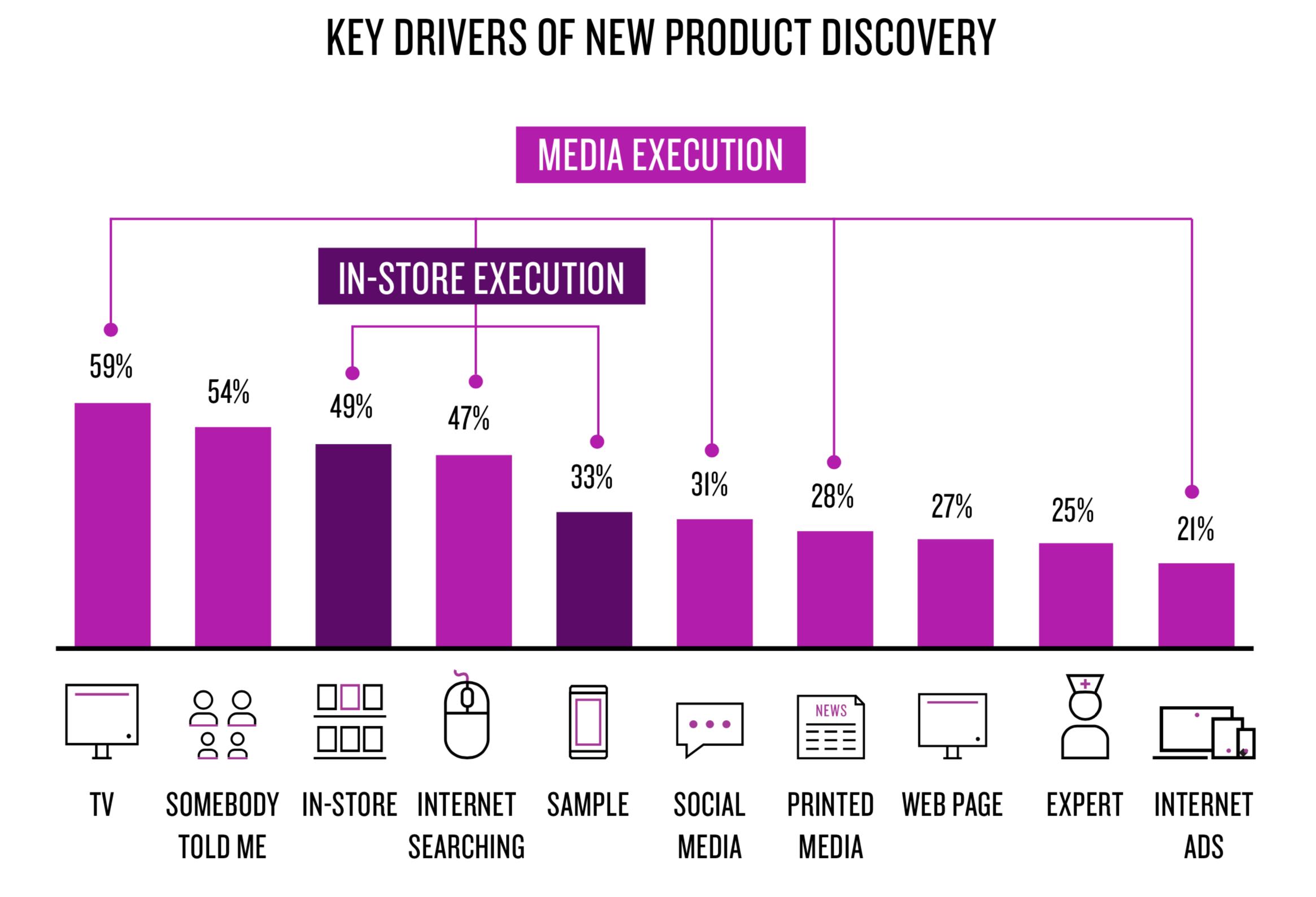

These platforms - and the internet in general - are also where millennials look for information about products. “Brands need to be present and ready to engage with and sell to millennials online and on social media," says Kantar.

What's in the basket?

Food manufacturers need to be aware of these income differences among Latin American millennials, which has a big impact on what they buy.

High-income households, which make up 34% of the millennial population in the region, tend to shop at hypermarkets and supermarkets, making use of their car to do a bulk weekly or even monthly grocery shop.

The value share supermarkets claim among high-income millennials grew from 45.3% in 2017 to 46.2% in 2018, compared to 33.1% for low-income shoppers, who make more frequent purchases as they tend to be paid on a weekly basis. Low-income millennials buy around 22% of their groceries on a daily basis in discounters or Cash & Carry stores, which offer attractive promotions.

E-commerce for FMCG remains niche in Latin America, although it is growing.

Higher-income households buy 0.15% of their groceries online, falling to 0.05% for low-income families.

“[However], this is set to be an increasingly key channel through which to reach millennials, with value share expected to reach 5% in Argentina and 3% in Brazil and Mexico by 2025,” writes Alva.

Personal care and beauty products, rather than food, will drive most of this growth.

Successful brands

So which brands are getting it right?

Rappi, the online delivery start-up that has been dubbed ‘Colombia’s Amazon’ has tapped into millennials’ desire to have “any product they want, whenever they want”, according to Alva.

With 13 million users and is valued at more than US$1 billion, making it one of Latin America’s rare ‘unicorns’.

Meanwhile, e-commerce giant Mercado Libre, an Argentinian company, and C&C Retailers Mercado Libre allow consumers to pay with their mobiles by scanning a QR code. They also offer discounts and let users of their app pay in installments.